The Insider View : The battle of the Bitcoin

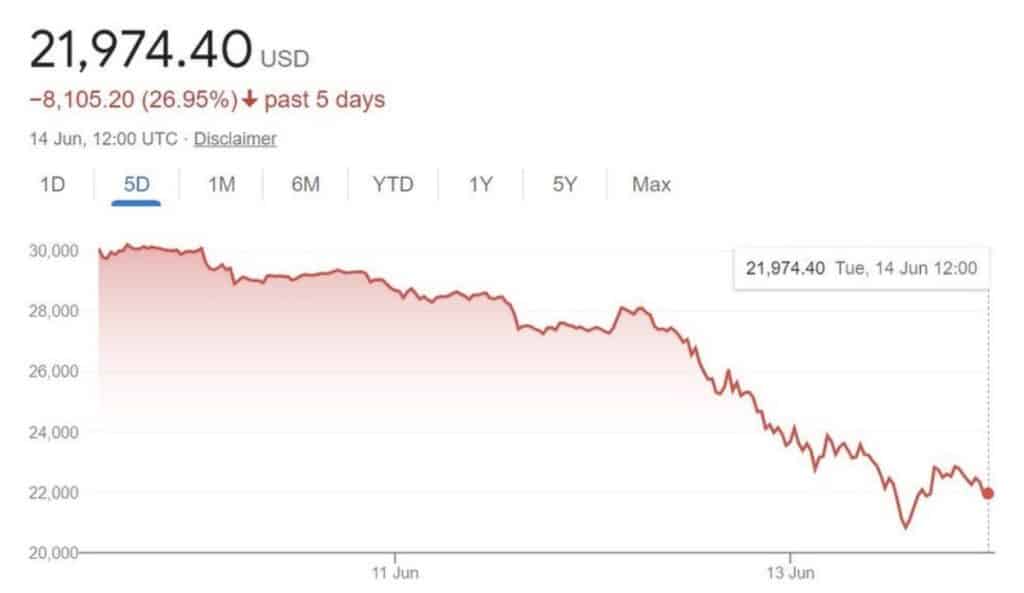

It is now impossible not to marvel at the roller coaster of a ride that bitcoin is giving to investors and spectators. Recently, BC fell 25% as we write this article. Holding at 70,000 USD not so long ago to 21,000 USD at this time. The S&P 500, is also on the slide.

If you tune into the global chatter it’s a wider issue. No one wants to hear the word ‘recession’ so we will go with an ‘economic downturn’. No doubt one of the largest inputs comes from the war Russia has waged on Ukraine, so the cost of living and inflation are on the rise.

It doesn’t matter what scale of wealth you have, there is less money to go around so investing in a crypto currency of any kind that’s unregulated and unprotected is the first thing to go from your shopping list.

Needless to say that may be part, or a large part of the demise of two coins that reached zero recently. Is that surprising?. Well, no because how can it be?. A crypto currency does not produce a tangible product; it does not fulfil a need like water, fuel, food or clothing. When you buy part of a coin you now need someone to jump in line behind you to pay more so the value rises and so on. Remarkably similar to a pyramid scheme when laid bare.

The need to cash-out is hard to resist; two of the main exchanges had to freeze withdrawals blaming technical errors but yet the panic continues. How bad will this actually get for BC and could it also collapse? The answer is yes, it could, although not likely. It will no doubt recover, but it doesn’t have a track record of doing so going back years like the S&P500, so we just have to wait and see.

Shrewd long term investors will not be worried as BC makes up only part of their portfolio and have it in for at least 5 years as a minimum. As long as they hold, BC will rise again and renewed interest will no doubt see it return to previous levels. The thing is no one can be absolutely sure.